Irs Mileage Rate Gas Prices . Web 17 rows the standard mileage rates for 2023 are: The higher mileage rates, which are used to calculate. Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. Web irs increases mileage rates because of high gas prices. Web washington—the internal revenue service raised the mileage rate used for calculating business tax. Web despite falling gas prices, the internal revenue service is increasing the optional standard mileage rate used to calculate. Web for 2024, the irs' standard mileage rates are $0.67 per mile for business, $0.21 per mile for medical or moving, and $0.14 per mile for charity. Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to.

from smithpatrickcpa.com

Web irs increases mileage rates because of high gas prices. Web 17 rows the standard mileage rates for 2023 are: Web despite falling gas prices, the internal revenue service is increasing the optional standard mileage rate used to calculate. The higher mileage rates, which are used to calculate. Web washington—the internal revenue service raised the mileage rate used for calculating business tax. Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. Web for 2024, the irs' standard mileage rates are $0.67 per mile for business, $0.21 per mile for medical or moving, and $0.14 per mile for charity. Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4.

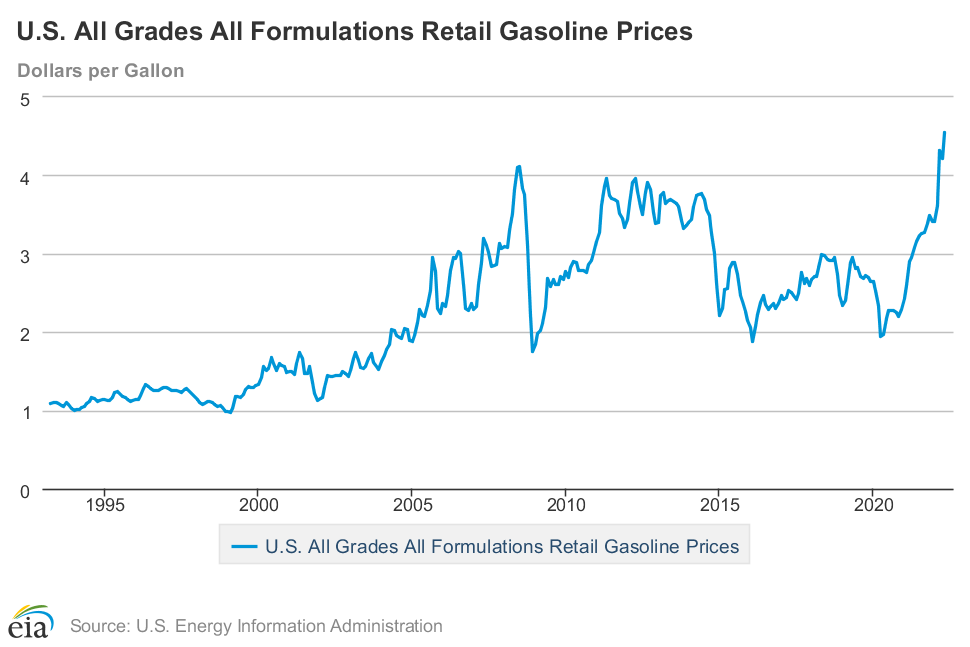

High Gas Prices Lead IRS to Increase Mileage Rate for 2022—Again Smith Patrick CPAs

Irs Mileage Rate Gas Prices Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. Web irs increases mileage rates because of high gas prices. Web despite falling gas prices, the internal revenue service is increasing the optional standard mileage rate used to calculate. Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. The higher mileage rates, which are used to calculate. Web for 2024, the irs' standard mileage rates are $0.67 per mile for business, $0.21 per mile for medical or moving, and $0.14 per mile for charity. Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. Web 17 rows the standard mileage rates for 2023 are: Web washington—the internal revenue service raised the mileage rate used for calculating business tax.

From www.mburse.com

2019 Guide to car allowances and mileage reimbursements Irs Mileage Rate Gas Prices Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. The higher mileage rates, which are used to calculate. Web irs increases mileage rates because of high gas prices. Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. Web 17 rows the standard mileage. Irs Mileage Rate Gas Prices.

From www.usatoday.com

IRS mileage rate How to claim mileage deductions on 2022 tax returns Irs Mileage Rate Gas Prices Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. The higher mileage rates, which are used to calculate. Web 17 rows the standard mileage rates for 2023 are: Web washington—the internal revenue service raised the mileage rate used for calculating business tax. Starting on july 1, the standard mileage rate — applying. Irs Mileage Rate Gas Prices.

From www.meetingsnet.com

Gas Prices Prompt IRS Mileage Adjustment Irs Mileage Rate Gas Prices Web 17 rows the standard mileage rates for 2023 are: The higher mileage rates, which are used to calculate. Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. Web despite falling gas prices, the internal revenue service is increasing the optional standard mileage rate used to calculate. Web irs increases mileage. Irs Mileage Rate Gas Prices.

From smithpatrickcpa.com

High Gas Prices Lead IRS to Increase Mileage Rate for 2022—Again Smith Patrick CPAs Irs Mileage Rate Gas Prices Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. Web 17 rows the standard mileage rates for 2023 are: Web for 2024, the irs' standard mileage rates are $0.67 per mile for business, $0.21 per mile for medical or moving, and $0.14 per mile for charity. Web despite falling gas prices, the. Irs Mileage Rate Gas Prices.

From www.wsj.com

IRS Raises Mileage Rates as Gas Prices Increase WSJ Irs Mileage Rate Gas Prices Web for 2024, the irs' standard mileage rates are $0.67 per mile for business, $0.21 per mile for medical or moving, and $0.14 per mile for charity. Web washington—the internal revenue service raised the mileage rate used for calculating business tax. Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. The. Irs Mileage Rate Gas Prices.

From smithpatrickcpa.com

High Gas Prices Lead IRS to Increase Mileage Rate for 2022—Again Smith Patrick CPAs Irs Mileage Rate Gas Prices The higher mileage rates, which are used to calculate. Web despite falling gas prices, the internal revenue service is increasing the optional standard mileage rate used to calculate. Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. Web for 2024, the irs' standard mileage rates are $0.67 per mile for business,. Irs Mileage Rate Gas Prices.

From www.stsw.com

2016 IRS Mileage Rate 54 Cents Per Mile Stevens and Sweet Financial Irs Mileage Rate Gas Prices Web irs increases mileage rates because of high gas prices. Web washington—the internal revenue service raised the mileage rate used for calculating business tax. Web despite falling gas prices, the internal revenue service is increasing the optional standard mileage rate used to calculate. The higher mileage rates, which are used to calculate. Web washington — the internal revenue service today. Irs Mileage Rate Gas Prices.

From www.msn.com

IRS increases standard mileage rate for 2024 despite lower gas prices Irs Mileage Rate Gas Prices Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. The higher mileage rates, which are used to calculate. Web irs increases mileage rates because of high gas prices. Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. Web despite falling gas prices, the. Irs Mileage Rate Gas Prices.

From scltaxservices.com

IRS Mileage Rates And Gas Prices Increase SCL Tax Services Irs Mileage Rate Gas Prices Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. Web washington—the internal revenue service raised the mileage rate used for calculating business tax. Web despite falling gas prices, the internal revenue service is increasing the optional standard mileage rate used to calculate. Web 17 rows the standard mileage rates for 2023 are:. Irs Mileage Rate Gas Prices.

From insights.bukaty.com

IRS lowers standard mileage rates for 2021 Irs Mileage Rate Gas Prices The higher mileage rates, which are used to calculate. Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. Web despite falling gas prices, the internal revenue service is increasing the optional standard mileage rate. Irs Mileage Rate Gas Prices.

From www.getcanopy.com

High Gas Prices Cause Midyear Mileage Rate Increase By IRS Canopy Irs Mileage Rate Gas Prices Web washington—the internal revenue service raised the mileage rate used for calculating business tax. Web irs increases mileage rates because of high gas prices. Web despite falling gas prices, the internal revenue service is increasing the optional standard mileage rate used to calculate. Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by. Irs Mileage Rate Gas Prices.

From www.amboyguardian.com

IRS Announces 2019 Mileage Rates The Amboy Guardian Irs Mileage Rate Gas Prices Web despite falling gas prices, the internal revenue service is increasing the optional standard mileage rate used to calculate. Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. Web for 2024, the irs' standard. Irs Mileage Rate Gas Prices.

From www.forbes.com

IRS Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher Gas Prices Irs Mileage Rate Gas Prices The higher mileage rates, which are used to calculate. Web for 2024, the irs' standard mileage rates are $0.67 per mile for business, $0.21 per mile for medical or moving, and $0.14 per mile for charity. Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. Web irs increases mileage rates because of. Irs Mileage Rate Gas Prices.

From www.wegnercpas.com

IRS Mileage Rate Increased in Response to High Gas Prices Wegner CPAs Irs Mileage Rate Gas Prices The higher mileage rates, which are used to calculate. Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. Web 17 rows the standard mileage rates for 2023 are: Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. Web washington—the internal revenue service raised. Irs Mileage Rate Gas Prices.

From www.taxgirl.com

IRS Releases Mileage Rates For 2023 Tax Year Taxgirl Irs Mileage Rate Gas Prices The higher mileage rates, which are used to calculate. Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. Web washington—the internal revenue service raised the mileage rate used for calculating business tax. Web despite. Irs Mileage Rate Gas Prices.

From www.hrmorning.com

2023 standard mileage rates released by IRS Irs Mileage Rate Gas Prices Starting on july 1, the standard mileage rate — applying to eligible business trips — increases by 4. Web washington—the internal revenue service raised the mileage rate used for calculating business tax. The higher mileage rates, which are used to calculate. Web for 2024, the irs' standard mileage rates are $0.67 per mile for business, $0.21 per mile for medical. Irs Mileage Rate Gas Prices.

From triplogmileage.com

IRS Issues Midyear Mileage Rate Increase Amid High Gas Prices Irs Mileage Rate Gas Prices Web washington — the internal revenue service today issued the 2024 optional standard mileage rates used to. Web despite falling gas prices, the internal revenue service is increasing the optional standard mileage rate used to calculate. The higher mileage rates, which are used to calculate. Starting on july 1, the standard mileage rate — applying to eligible business trips —. Irs Mileage Rate Gas Prices.

From twitter.com

IRSnews on Twitter "IRS increases the mileage rate for the remainder of 2022. See http//irs Irs Mileage Rate Gas Prices Web 17 rows the standard mileage rates for 2023 are: Web despite falling gas prices, the internal revenue service is increasing the optional standard mileage rate used to calculate. The higher mileage rates, which are used to calculate. Web washington—the internal revenue service raised the mileage rate used for calculating business tax. Web irs increases mileage rates because of high. Irs Mileage Rate Gas Prices.